|

PROCEDURES:

|

Background

Personal use of an employer-provided vehicle is defined as any use of the vehicle that is for commuting to/from work, or that was not for a substantiated business purpose. Some vehicles are exempt from the substantiation requirement. A list of the types of vehicles that are exempt are listed below. If the vehicle you are driving does not qualify under the list, you are required to report the personal miles driven as personal use.

What Vehicles Are Exempt from Substantiation Requirements?

Any vehicle that, by reason of its nature, is not likely to be used more than a very limited (de minimis) amount for personal purposes is exempt from the substantiation requirements generally imposed on employer provided cars. The term “qualified non-personal use vehicle” is applied to these types of vehicles.

Examples of “qualified non-personal use vehicles” that fall within this exception are:

-

Forklifts;

-

Cement mixers;

-

Dump trucks;

-

Garbage trucks;

-

Refrigerated trucks;

-

Tractors and other special purpose farm vehicles;

-

Combines;

-

Flatbed trucks;

-

Bucket trucks (“cherry pickers”);

-

Delivery trucks with seating only for the driver, including those with a jump seat;

-

Any vehicle designed to carry cargo with a loaded gross vehicle weight over 14,000 pounds;

-

Cranes and derricks;

-

School buses, ambulances and hearses used as such;

-

Clearly marked police and fire vehicles, but personal use other than commuting must be prohibited by the employer;

-

Unmarked law enforcement vehicles, but personal use must be incident to the employee's law-enforcement functions (e.g., the ability to respond to emergency situations or report directly to a surveillance site) (see “Law enforcement officer”, below).

-

Passenger buses used as such with a capacity of at least 20 passengers;

-

Moving vans used by professional moving companies, but personal use must be restricted by the employer; and

-

Trucks specially designed to carry and store equipment for emergency utility repairs (e.g., restoring or maintaining electricity, gas, or water utility services).

Vans and pickup trucks

Vans and pickup trucks are not automatically classified as exempt vehicles because they can be easily used for personal purposes. However, if a van or pickup truck has been specially modified with the result that it is not likely to be used more than a de minimis amount for personal purposes, it will be classified as a “qualified non-personal use vehicle” and exempt from the substantiation requirements. For example, a van that has only a front bench for seating in which permanent shelving has been installed, that constantly carries merchandise, and that has been specially painted with advertising or the company's name will qualify as a vehicle not susceptible to personal use.

Law enforcement officer

In order for an unmarked police vehicle (see 15, above) to be classified as a qualified non-personal use vehicle, it must be used by a law enforcement officer.

A “law enforcement officer” is an individual who is a full-time employee of a governmental unit that is responsible for the prevention or investigation of crime. In addition, the employee must be authorized by law to carry firearms, execute search warrants, and make arrests. The employee must regularly carry firearms except when it is not possible to do so due to the requirements of undercover work. Special agents appointed by a state commission to conduct criminal investigations into the conduct of public officials are law enforcement officers. The agents are authorized to execute search warrants, make arrests, and carry firearms.

IRS Valuation Methods

The Internal Revenue Service regulations allow one of three different valuation methods to be used. These methods include the Cents-Per-Mile Rule, the Commuting Rule, and the Lease Value Rule.

-

The Cents-Per-Mile Rule

has many restrictions. This rule requires the vehicle be used at least 50% for business purposes, or that the vehicle is actually driven at least 10,000 miles during the year. This method of valuation may not be used if the value of the vehicle, when first made available to any employee for personal use, is more than $16,000 for passenger vehicle (Reg. §1.61-21(e)(1); Reg. 1.280F). An additional mileage rate for fuel is also included if fuel is provided. See the IRS website for the annual fuel mileage rate here: IRS Standard Mileage Rates.

- The Commuting Rule

valuation is $1.50 for each one-way trip, or $3.00 for each round trip between the employee’s home and office. It may only be used if ALL

of the following apply:

a. The vehicle is provided for business use and if for non-compensatory business reasons, you are required to commute in the vehicle

b. There is an established written policy under which IU does not allow the employee to use the vehicle for personal purposes, other than commuting or de minimis personal use

c. The employee does not use the vehicle for personal purposes, other than commuting and de minimis personal use

d. The employee who uses it for commuting is not a highly compensated employee. The IRS provides this definition and limit each year in the

IRS Publication 15-B, Employer’s Tax Guide to Fringe Benefits.

- The Lease Value Rule

requires that we calculate the taxable amount of personal use based on the annual lease value (ALV). This is determined by using the fair market value (FMV) of the vehicle on the first date it is available to any employee for personal use. The IRS issues a table that displays the FMV and the corresponding ALV. The ALV’s in the table are based on a 4-year lease term. The FMV may be recalculated if certain types of transfers of the vehicle occur or after the vehicle is 4 years old. Total personal miles, as a percentage of total miles driven, are multiplied by the ALV to determine the taxable amount to include in income. If the vehicle is held for less than one year, the value will be adjusted accordingly.

Procedures

In general, IU utilizes the Lease Value Rule for calculating taxable income related to personal use of an IU vehicle. If an alternate method ( Cents-per-Mile or Commuting

) is desired and applies, the employee should contact taxpayer@iu.edu.

Vehicle data Submission - Lease Value Rule

At IU, the Chrome River transaction system is utilized to submit personal mileage information for an IU-owned vehicle. The following is the step-by-step procedure to submit information to University Tax Services for processing. For questions, please contact

taxpayer@iu.edu.

-

Open Chrome River tile through One.IU. You will enter the mileage information as an employee or as a delegate for an employee if submitting a mileage report on behalf of another employee.

-

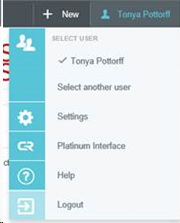

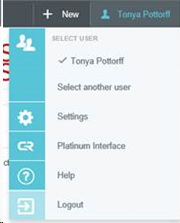

If entering as a DELEGATE – Click your user name, then click “Select another user” to find the employee that you are entering on behalf of. In this example, Cassandra Franks is the delegate for Tonya Pottorff.

-

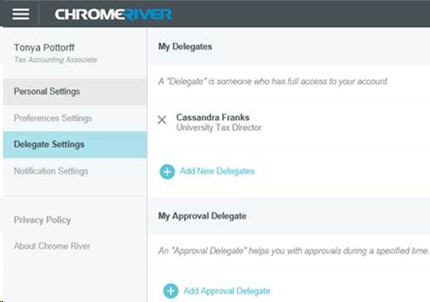

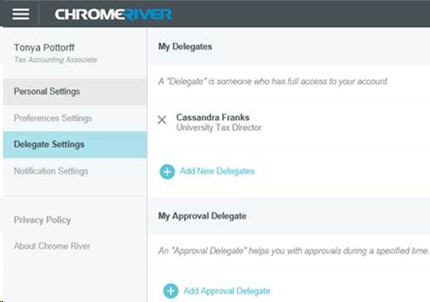

NOTE: The employee entering on behalf of, must first be setup as a delegate. The employee with an IU vehicle can do this by clicking on settings, then Delegate Settings, and Add New Delegates under My Delegates:

-

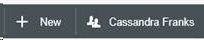

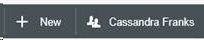

Verify the new user name is correct before you begin entering:

In the top right-hand corner, select the  button to create a new expense report. button to create a new expense report.

-

NOTE: An expense report should be submitted PER VEHICLE. If multiple vehicles, separate expense reports should be completed.

Input Report Name as desired, and Pay Me In as the default USD US Dollar selection.

For Report Type, select “Personal Use of an IU Vehicle”, then select  in the top right.

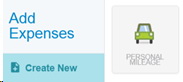

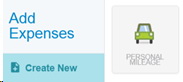

You should now see your report information on the left side of the screen and a new tile will appear on the right side for Personal Mileage. Select the green car tile for Personal Mileage. in the top right.

You should now see your report information on the left side of the screen and a new tile will appear on the right side for Personal Mileage. Select the green car tile for Personal Mileage.

The Date field will be auto populated for the current date so no change is needed.

The Spent field will auto-populate based on the information added below, so no change is needed. This field represents what amount will be added to wages for the employee as taxable income related to personal use of the car.

The Date field will be auto populated for the current date so no change is needed.

The Spent field will auto-populate based on the information added below, so no change is needed. This field represents what amount will be added to wages for the employee as taxable income related to personal use of the car.

-

NOTE: The Spent amount represents wages added, not additional taxes. Taxes will be taken from the paycheck as a percentage of the wages. For example, if $100 represents the personal use of the car (Spent), and the tax rate is 30%, then $30 will be taken from the next paycheck and will reduce net pay. 30% may be used as a rough percent estimate to calculate the amount of taxes that will reduce net pay.

The Pickup Date field represents the start of the reporting period for the vehicle. Reports are required to be submitted via Chrome River on a monthly basis.

-

Monthly Report – use first day of each month, see Return Date below.

-

Submit info by the 15th of the following month.

- EXAMPLE: An IU car is in use from August 7th to September 10th, therefore two reports should be filed, one for August with a Pickup Date of August 7th (submitted by September 15th) and another report for September with a Pickup Date of September 1st (submitted by October 15 th). See Return Date below.

The Return Date field represents the end of the reporting period for the vehicle.

-

-Monthly Report – use last day of each month, see Pickup Date above.

-

-Submit info by the 15

th

of the following month.

-

· EXAMPLE: An IU car is in use from August 7

th

to September 10

th

, therefore two reports should be filed, one for August with a Return Date of August 31

st

(submitted by September 15

th

) and another report for September with a Return Date of September 10

th

(submitted by October 15

th

). See Pickup Date above.

The Number of Days field will be auto-populated based on the date entries from #8 and #9 above.

The Auto FMV field represents the estimated Fair Market Value (FMV) of the car, please enter a best estimate of FMV based on the first day made available/assigned. This value should be evaluated and updated (if needed) an on annual basis. Kelly Blue Book may also be used if an estimate was not provided to the employee. If utilizing a car from the Motor Pool, please consult with the Motor Pool for questions concerning FMV.

The VIN# field represents the Vehicle Identification Number (VIN). This field is optional and should be used for departmental use, either the VIN or University vehicle number.

The Year, Make, Model

field should be entered for every report provided and should represent only one vehicle at a time. Separate reports should be submitted for multiple vehicles.

The University Business Miles

field represents miles driven for IU business for the specified reporting period - examples include recruiting, meetings, etc. This field should not include miles used for commuting from home to office.

The Personal Miles

field represents personal mileage for the specified reporting period. This field should include commuting miles from home to office and other personal mileage used.

The fields Total Miles Driven, Value of Car, Personal Mileage Percentage

and Calculated Personal Value

are all auto-populated fields based on information entered above in the form.

The checkbox for Gas Card

should be checked if the employee also holds a gas card related to the use of the IU vehicle. If no gas card is used, leave unchecked. This would also include utilizing gas at the Fleet Services pumps.

The field Gas Card Total

is auto populated based on the checkbox from #17 above.

The Mileage log attached

checkbox should be checked if additional documentation is included. Additional documentation should be kept at the department/employee level and is not required for submission to University Tax Services, but may be kept on the expense report as an attachment if desired by the department/employee.

Complete the Allocation

field as appropriate for the Buy.IU account associated with the expense.

Verify all information is entered correctly and click the  button again on the top right corner.

Click the Submit button on the bottom left side of the screen to submit the information to University Tax Services. For any questions, contact University Tax Services. button again on the top right corner.

Click the Submit button on the bottom left side of the screen to submit the information to University Tax Services. For any questions, contact University Tax Services.

NOTE: The amount under “Total Pay Me Amount” will NOT be additional cash compensation. This is the amount that will be added to the paycheck to represent the non-cash compensation for personal use of the vehicle. To determine taxes to be paid, multiply the Total Pay Me Amount by 30%, and this will provide a rough estimate of the reduction in net pay.

|

button to create a new expense report.

button to create a new expense report.  in the top right.

in the top right.

button again on the top right corner.

button again on the top right corner.