|

TSOP NO: |

3.03 |

|

SUBJECT: |

Calculating Box Totals on Form W-2 |

|

SOURCE: |

University Tax Services |

|

ORIGINAL DATE OF ISSUE: |

1/1/2018 |

|

DATE OF LAST REVISION: |

1/1/2018 |

|

RATIONALE: |

To provide employees at Indiana University a how-to guide on recalculating the amounts appearing on the Form W-2 and specifically, Box 1 of the Form W-2. |

|

PROCEDURES: |

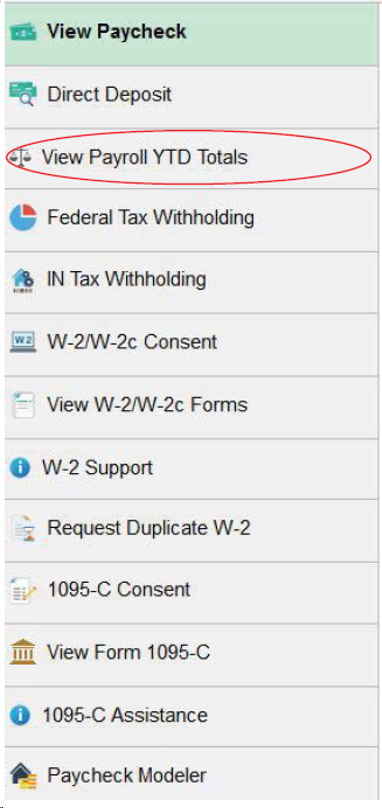

BackgroundEvery year during tax season, employees at Indiana University receive a W-2. The numbers appearing on your W-2 can be recalculated by looking at payroll year-to-date (YTD) totals for the full calendar year. The W-2 below can be used as an example for following the step-by-step instructions on how to recalculate the boxes found on the W-2.

Form W-2, Box 1· The amount in Box 1 of your W-2 represents your federal taxable wages for the year. In general, the equation below is used to calculate federal taxable wages: Box 1 on W-2 = Earnings – Before Tax Deductions + Noncash Taxable Fringe Benefits The following steps are an example of how to recalculate Box 1 of your W-2:

There are no taxable noncash fringe benefits in this example, however, an example of what one would look like is below (Note that in the example below, this person has received a total of $15,955.76 in tuition benefit but they are only being taxed on the portion above the $5,250 threshold).

Form W-2, Box 2Box 2 represents the total amount of federal income tax withheld from your pay during the year. The following steps are an example of how to recalculate Box 2 of your W-2:

Form W-2, Box 3Box 3 represents the amount of social security wages that are subject to social security tax. In general, Box 3 is calculated the same as Box 1 with a few exceptions. The following steps are an example of how to recalculate Box 3 of your W-2: 1. Go to the Payroll YTD Totals screen. 2. Add any contributions you (do not add employer contributions) made to a tax deferred retirement account (45,839.33 + 2,795.62 = 48,634.95). These can be found by looking for the following in Before-Tax Deductions:

3. Social security wages have a maximum taxable amount. Please visit the Social Security Administration website for the latest annual limit. Any amount above the annual limit is not subject to social security tax.

Form W-2, Box 4· Box 4 represents the social security tax being withheld on social security wages (Box 3). The following steps are an example of how to recalculate Box 4 of your W-2:

Form W-2, Box 5Box 5 represents the amount of Medicare wages that are subject to Medicare tax. In general, Box 5 is calculated the same as Box 3. The main difference stems from there being no limit on Medicare taxable wages. The following steps are an example of how to recalculate Box 5 of your W-2:

Form W-2, Box 6Box 6 represents the Medicare tax being withheld on Medicare wages (Box 5). The following steps are an example of how to recalculate Box 6 of your W-2:

Form W-2, Box 10Box 10 represents before tax dependent care benefits. The following steps are an example of how to recalculate some of the codes in Box 10 of your W-2:

Form W-2, Box 12Box 12 provides various information. Codes are used on the W-2 to represent the different types of information presented. The following steps are an example of how to recalculate some of the codes in Box 12 of your W-2:

ii. Health Eng Addl Prm-Nontaxable iii. Health Eng Addl Prm-Pre Tax iv. Health Eng Addl Prm-Taxable v. Medical After Tax vi. EE Paid Medical Billing vii. Medical Plan (GD) viii. Medicl Pln ix. Taxable Medical

ii. 403(b) age 50 & over CU (GD) iii. Tax Deferred Account iv. 403(b) age 50 & over Catch-Up i. IU Retirement Savings Plan-GD

ii. Health Savings Account

Form W-2, Box 14

The following steps are an example of how to recalculate some of the codes in Box 14 of your W-2:

II. NO PAY-Pers use of vehicle-taxCode Q – Tuition Benefit I. NO PAY-Tuition Benefit Form W-2, Box 16

Form W-2, Box 17

The following steps are an example of how to recalculate Box 17 of your W-2:

Form W-2, Box 18

Form W-2, Box 19

The following steps are an example of how to recalculate Box 19 of your W-2:

|

|

DEFINITIONS: |

|

|

CROSS REFERENCES: |